These plans are typically a solution for individuals who are not offered health insurance through employment, do not qualify for Medical Assistance, and are not eligible for Medicare. For those in retirement, but not quite ready for Medicare yet, Individual/Family Plans can bridge the coverage gap until Medicare eligibility.

Breitenfeldt Group compares all options available to each individual based their unique situation. Our team is here to assist with all stages of planning and enrollment into Individual and Family plans.

contact us

Costs for these types of plans depend on a variety of factors. Purchasing a plan through a State or Federal marketplace (on-exchange) is the only place you can apply for financial help to lower the cost of your monthly premium and out-of-pocket costs. The amount of financial help is based on a sliding scale, so the lower your income, the higher the amount of assistance.

Absolutely. All plans we represent at Breitenfeldt Group do not discriminate based on pre-existing conditions. This means you cannot be denied coverage or charged a higher premium based on your health status. In addition, all the plans we represent include coverage for the 10 essential health benefits mandated under the Affordable Care Act. These benefits include guaranteed coverage for emergency services, hospitalization, prescription medications, and preventative care.

Open enrollment is a set time period each year when individuals can enroll in Individual/Family Health Plans offered on- and off-exchange. During this time period you can also change or renew your current coverage in an Individual/Family Plan. This time period is usually in the fall and early winter months.

Individuals who experience certain life events (such as birth of child/adoption, getting married, change of address or income) may qualify for a special enrollment period which would allow them to enroll in an Individual/Family Plan outside the annual open enrollment period.

For people who have experienced a job loss, COBRA (the Consolidated Omnibus Budget Reconciliation Act) coverage can be expensive. If you lose your job-based coverage, you can choose to buy an Individual/Family Plan as an alternative to COBRA. Breitenfeldt Group advisors can help you determine if taking COBRA or choosing an Individual/Family Plan is better for your situation.

Every Individual/Family Plan has a provider network. A provider network is a list of the health care providers (like doctors, psychologists, and physical therapists) and health care facilities (like hospitals, urgent care clinics, and pharmacies) that a health insurance plan contracts with to provide care to its members. It’s important to choose a plan that coordinates with where you want to receive your health care because using providers in your plan’s network, will likely keep your costs lower. If you use an out-of-network provider, you will likely pay more for those services.

The advisors at Breitenfeldt Group are able to help you find the right plan for your situation. We are appointed with all the major insurance carriers (both on- and off-exchange) and offer the same coverage at the same cost to help simplify your transition onto an Individual/Family Plan.

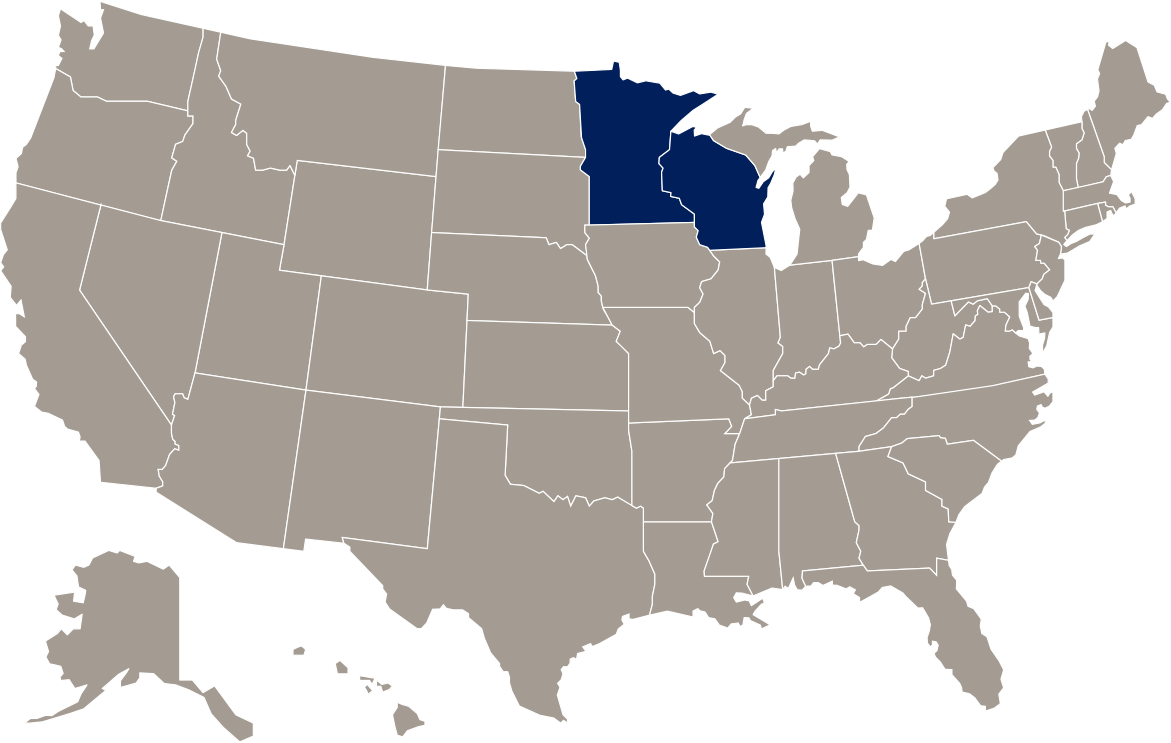

Breitenfeldt Group is licensed in Minnesota and Wisconsin to assist with Individual & Family Plans.